mississippi income tax rate 2021

Mississippis sales tax rate. Mississippi Income Tax Calculator 2021.

Cryptocurrency Taxes What To Know For 2021 Money

IndividualFiduciary Income Tax Voucher REPLACES THE 80-300 80-180 80-107 IncomeWithholding Tax Schedule.

. Detailed Mississippi state income tax rates and brackets are available on this page. Detailed Mississippi state income tax rates and brackets are available on this page. For the Single Married Filing Jointly Married Filing Separately and Head of Household filing statuses the MS tax rates and the number of tax brackets remain the.

There is no tax schedule for Mississippi income taxes. Title 27 Chapter 7 Mississippi Code Annotated 27-7-1 S Corporation Income Tax Laws. Tax rate of 5 on taxable income over 10000.

Discover Helpful Information and Resources on Taxes From AARP. Your average tax rate is 1801 and your marginal tax rate. Taxable and Deductible Items.

Mississippis individual income tax rate schedule tax year 2021 all filers 3 4000 4 5000 5 10000 source. Mississippi Income Tax Calculator 2021. 079 average effective rate.

Mississippi State Tax Quick Facts. 100000 Tax Year 2025. In tax year 2021 only 1000 in marginal income will be subject to the 3 percent rate with the other 1000 exempt.

Tax Rates Exemptions Deductions. Tax Rates Exemptions. Detailed Mississippi state income tax rates and brackets are available on this page.

Tax Year 2021. Franchise tax repealed effective January 1 2028. Your average tax rate is 1350 and your marginal tax rate.

TAXES 21-17 Mississippi State Income Tax Withholding. March 29 2021 Effective. If filing a combined return both spouses workeach spouse c See more.

Your average tax rate is 1198 and your marginal tax rate. Pay Period 05 2021. The income tax withholding formula for the State of Mississippi includes the following changes.

Corporate Income Tax Returns 2021. 100000 Tax Year 2022. 100000 Tax Year 2026 The Mississip.

Your 2021 Tax Bracket to See Whats Been Adjusted. 18 cents per gallon of regular gasoline and diesel. Tax rate of 4 on taxable income between 5001 and 10000.

How do I compute the income tax due. The tax brackets are the same for all filing statuses. 100000 Tax Year 2023.

80-100 Individual Income Tax Instructions. Mississippi residents have to pay a sales tax on goods and services. If you make 150000 a year living in the region of Mississippi USA you will be taxed 34094.

100000 Tax Year 2028 or. The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022. Mississippi sales tax rates.

The standard deduction for No W-4 filed has. 0 on the first 4000 of taxable income. The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022.

Mississippi has a graduated income tax rate and is computed as follows. The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022. At what rate does Mississippi tax my income.

The graduated income tax rate is. 4 on the next 5000 of taxable income. Title 27 Chapter 8 Mississippi Code Annotated 27-8-1 Corporate Franchise Tax Laws.

The next 1000 is taxed at 3. 71-661 Installment Agreement. And all taxable income over 10000 is taxed at 5.

100000 Tax Year 2024. Starting in 2022 only the 4 percent and 5 percent rates will remain with the first 5000 of income exempt from taxation up from 3000. Mississippi Income Tax Calculator - Smartasset.

Mississippi Income Tax Calculator 2021. Mississippi income tax rate. Title 27 Chapter 13 Mississippi Code.

The first 4000 of taxable income is exempt. Income Tax Laws Title 27 Chapter 7 Mississippi Code Annotated 27-7-1. 3 on the next 2000 of taxable income.

100000 Tax Year 2027. Ad Compare Your 2022 Tax Bracket vs. If you make 70000 a year living in the region of Mississippi USA you will be taxed 11472.

0 on the first 3000 of taxable income. 4 on the next 5000 of taxable income. The next 5000 of taxable income is taxed at 4.

5 on all taxable income over 10000. 5 on all taxable income over 10000. 3 on the next 1000 of taxable income.

If you make 82500 a year living in the region of Mississippi USA you will be taxed 14847.

Tax Rate Schedules And Important Rules For 1099 Contractors Taxhub

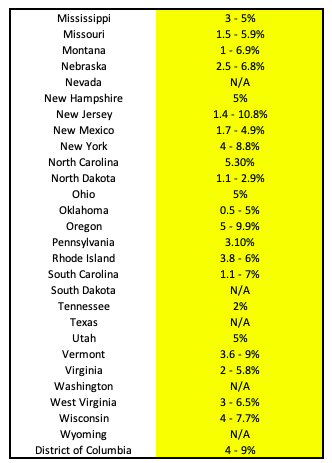

State Corporate Income Tax Rates And Brackets Tax Foundation

2022 Capital Gains Tax Rates By State Smartasset

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

How Racial And Ethnic Biases Are Baked Into The U S Tax System

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Mississippi State Tax Return Etax Com

How Do State And Local Individual Income Taxes Work Tax Policy Center

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

House Passes Mississippi Tax Freedom Act Of 2022 Mississippi Thecentersquare Com

Which States Pay The Most Federal Taxes Moneyrates

Mississippi Income Tax Rate And Ms Tax Brackets 2022 2023

Mississippi Lawmakers Pass Largest Tax Cut In State History Mississippi Today

Mississippi Tax Rate H R Block

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities